Key financial information

Consolidated Financial Statements

(in 000 EUR)

| 31/03/2023 | 31/03/2022 | 31/03/2021 | 31/03/2020 | 31/03/2019 | |

|---|---|---|---|---|---|

| Equity | 1 312 409 | 1 413 034 | 1 274 280 | 1 104 924 | 1 321 252 |

| Portfolio | 1 522 898 | 1 448 547 | 1 232 929 | 1 016 984 | 1 081 826 |

| Cash and cash equivalents | 194 416 | 377 828 | 517 480 | 368 041 | 276 699 |

| Balance sheet total | 1 728 549 | 1 840 594 | 1 762 984 | 1 399 429 | 1 371 319 |

| Net profit | -59 467 | 174 285 | 205 724 | -151 573 | 112 079 |

| Total gross dividend *1 | 69 302 | 65 073 | 63 567 | 63 567 | 63 567 |

| Investments (own balance sheet) | 260 649 | 193 830 | 211 129 | 204 885 | 189 008 |

| Divestments (own balance sheet) | 175 037 | 218 920 | 265 510 | 179 404 | 196 205 |

| Number of employees | 93 | 90 | 89 | 91 | 91 |

Key figures per share

| 31/03/2023 | 31/03/2022 | 31/03/2021 | 31/03/2020 | 31/03/2019 | |

|---|---|---|---|---|---|

| Equity | 48.2 | 53.0 | 49.0 | 43.5 | 52.0 |

| Net profit | -2.20 | 6.59 | 7.96 | -5.96 | 4.41 |

| Gross dividend | 2.60 | 2.50 | 2.50 | 2.50 | 2.50 |

| Share price (on the closing date of the financial year) | 44.50 | 54.60 | 51.00 | 47.55 | 50.00 |

| Total numbers of shares | 27 220 734 | 26 654 508 | 25 841 318 | 25 426 672 | 25 426 672 |

Financial ratios

| 31/03/2023 | 31/03/2022 | 31/03/2021 | 31/03/2020 | 31/03/2019 | |

|---|---|---|---|---|---|

| Pay-out ratio | n.a. | 37.4% | 30.9% | -41.9% | 56.7% |

| Net return on equity | -4.2% | 13.7% | 18.6% | -11.5% | 8.8% |

| Gross return on portfolio *1 | -0.1% | 20.4% | 27.0% | -10.3% | 16.2% |

| Premium (+) / discount (-) on equity | -7.7% | 3.0% | 4.1% | 9.3% | -3.8% |

*1 Realised capital gains + unrealised capital gains on financial fixed assets + dividends + interests / portfolio at start of financial year

Comments for the reader: the decimal character is a full stop; thousands are separated by a space.

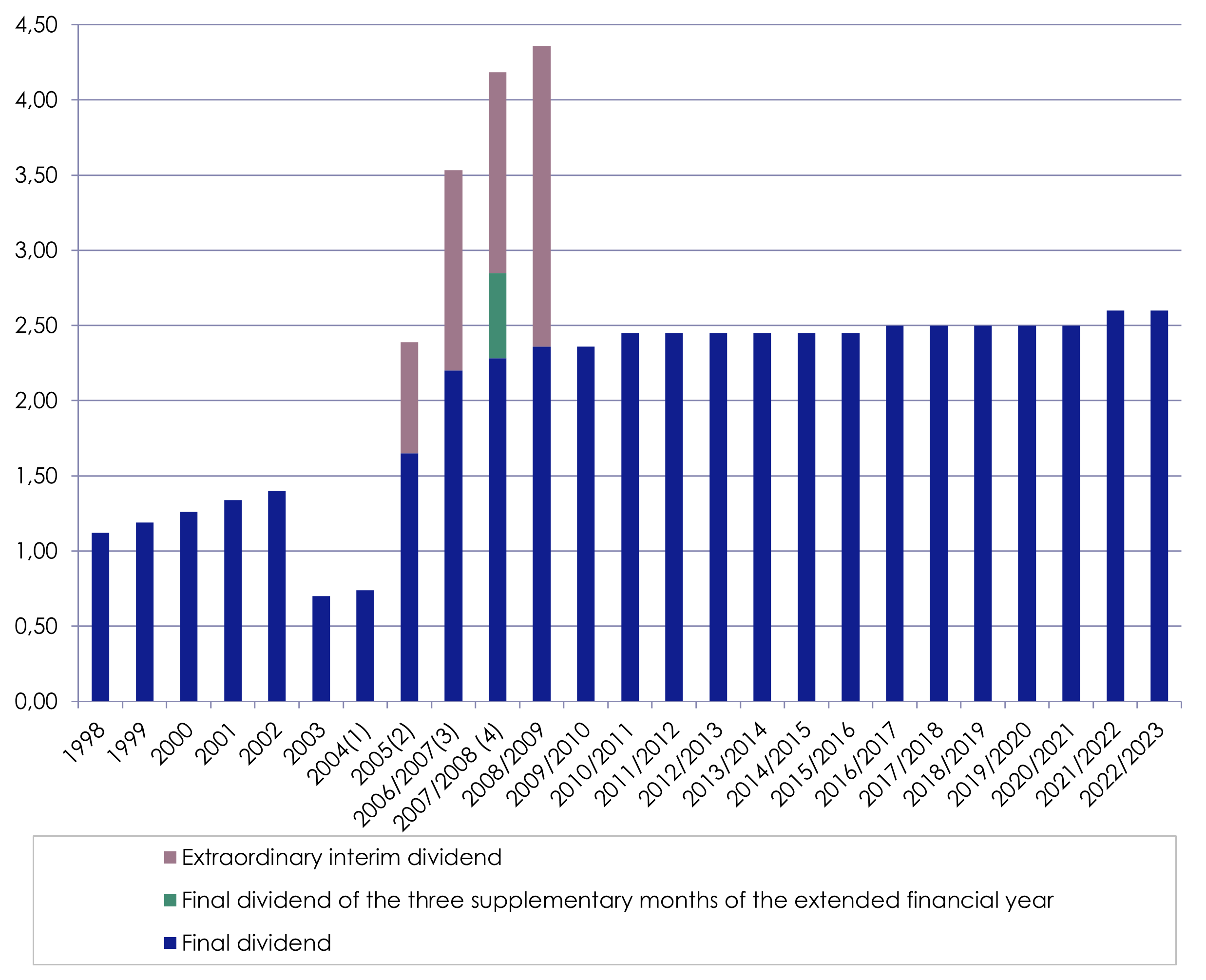

Dividend

The General Meeting of 28 June 2023 has decided to pay a gross dividend of EUR 2.60 (EUR 1.82) per share for the financial year 2022-2023. This evolution is consistent with Gimv's dividend policy of not lowering the dividend, except in exceptional circumstances, and to increase it whenever sustainably possible.

Optional dividend 2023

On 28-06-2023 the GM accepted the proposal from the Gimv’s Board of Directors to pay a gross dividend of EUR 2.60 (EUR 1.82 net) per share for the 2022-2023 financial year in the form of an optional dividend. As from 3 July 2023, shareholders will have the option to contribute their dividend to Gimv’s capital.

- Outcome of the optional dividend for the financial year 2022-2023 (press release EN)

- Modalities of the optional dividend for the financial year 2022-2023 (press release NL/FR)

- Information note optional dividend 2022-2023 (NL/FR)

- Statutory auditor's report on the optional dividend (NL)

- Gimv special report of the board of directors - in-kind contribution (optional dividend) (NL)

Dividend history

Download Gimv dividend history

| Financial year | Coupon number | Gross dividend | Ex-coupon | Record date | Payment date |

|---|---|---|---|---|---|

| 2022-2023 | 30 | 2.60 | 03/07/2023 | 04/07/2023 | 28/07/2023 |

| 2021-2022 | 29 | 2.60 | 04/07/2022 | 05/07/2022 | 28/07/2022 |

| 2020-2021 | 28 | 2.50 | 05/07/2021 | 06/07/2021 | 30/07/2021 |

| 2019-2020 | 27 | 2.50 | 29/06/2020 | 30/06/2020 | 28/07/2020 |

| 2018-2019 | 26 | 2.50 | 01/07/2019 | 02/07/2019 | 03/07/2019 |

| 2017-2018 | 25 | 2.50 | 02/07/2018 | 03/07/2018 | 04/07/2018 |

| 2016-2017 | 24 | 2.50 | 03/07/2017 | 04/07/2017 | 05/07/2017 |

| 2015-2016 | 23 | 2.45 | 03/07/2016 | 04/07/2016 | 06/07/2016 |

| 2014-2015 | 22 | 2.45 | 29/06/2015 | 30/06/2015 | 01/07/2015 |

| 2013-2014 | 21 | 2.45 | 27/06/2014 | 01/07/2014 | 01/08/2014 |

| 2012-2013 | 20 | 2.45 | 28/06/2013 | 02/07/2013 | 02/08/2013 |

| 2011-2012 | 19 | 2.45 | 29/06/2012 | 03/07/2012 | 03/08/2012 |

| 2010-2011 | 18 | 2.45 | 04/07/2011 | 06/07/2011 | 07/07/2011 |

| 2009-2010 | 17 | 2.40 | 05/07/2010 | 07/07/2010 | 08/07/2010 |

| 2008-2009 | 16 | 2.36 | 26/06/2009 | 30/06/2009 | 01/07/2009 |

| 2007-2008 | 15 | 2.36 | 27/06/2008 | 30/06/2008 | 03/07/2008 |

| 2006-2007 | 14 | 2.00 | 06/12/2007 | ||

| 2006-2007 | 13 | 2.85 | 02/07/2007 | ||

| 2005-2006 | 12 | 1.33 | 06/12/2006 | ||

| 2005-2006 | 11 | 2.20 | 06/06/2006 | ||

| 2004-2005 | 10 | 1.33 | 15/11/2005 | ||

| 2004-2005 | 9 | 1.65 | 31/05/2005 | ||

| 2003-2004 | 8 | 0.74 | 29/10/2004 | ||

| 2003-2004 | 7 | 0.74 | 01/06/2004 | ||

| 2002-2003 | 6 | 0.70 | 03/06/2003 | ||

| 2001-2002 | 5 | 1.40 | 31/05/2002 | ||

| 2000-2001 | 4 | 1.34 | 01/06/2001 | ||

| 1999-2000 | 3 | 1.26 | 13/06/2000 | ||

| 1998-1999 | 2 | 1.19 | 11/06/1999 | ||

| 1997-1998 | 1 | 1.12 | 11/06/1998 |